Audits ensure that financial statements reflect accurate financial data. Regular audits are crucial for financial transparency in real estate accounting. Advanced software solutions offer features for audit trails, ensuring transparency. Regular reviews refine these audits, ensuring they remain aligned with accounting standards. For real estate professionals, regular audits are crucial for stakeholder trust.

Ethical Considerations in Trust Accounting and Reporting

Adapting to these technological advancements is crucial for modern real estate accounting. This involves integrating with modern tools and staying updated with technological changes. Accurate financial data is the cornerstone of informed decision-making.

Embracing Technology and Collaboration for Good Real Estate Accounting

- This involves disclosing any potential conflicts, abstaining from self-dealing, and acting in the best interests of the trust beneficiaries at all times.

- If mathematics was not your forte and you chose a career in property management to avoid crunching the numbers, we can imagine the shock when you learned you would be managing real estate trust accounts.

- By subtracting operating expenses from rental income, investors can assess the property’s profitability.

- Factors such as location and property type can influence cap rates.

- For real estate professionals, financial forecasting is a core skill.

They should be used to store payments for deposits, bonds, upfront fees, and some rental incomes. All the rules and regulations involved with renting or leasing real estate properties can get a little confusing. These valuation pitfalls can result in you losing the trust of your investors and can even lead to compliance and auditing issues.

Disadvantages of REIT Status

- Real estate accounting involves the systematic recording, analysis, and interpretation of financial information related to real estate transactions.

- Training sessions offer insights into cost optimization strategies.

- But there are some big differences due to the accounting treatment of property.

- Trust account reconciliation is the process of comparing trust account records with bank statements to identify discrepancies, errors, or potential fraud.

- Moreover, clear protocols ensure consistent and accurate preparation.

- If only they’d put the money into a trust account, where they wouldn’t be tempted to spend it.

It ensures that properties are consistently depreciated, reflecting their true wear and tear. Understanding their nuances is essential for accurate revenue recognition. Different lease structures can impact when and how revenue is recognized. For instance, a stepped rent lease might have varying rental amounts over its term. Recognizing this revenue correctly ensures that financial statements reflect true income patterns. Regular reviews of lease agreements can highlight any changes or amendments.

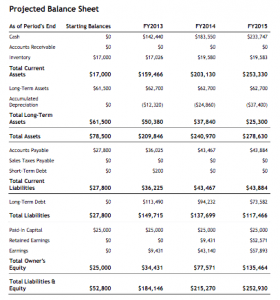

- Balance sheets provide a snapshot of a property’s assets, liabilities, and equity.

- Properties often have multiple revenue streams, from rentals to parking fees.

- REITs hold real estate investments, which are depreciated over time for tax purposes.

- Known as a Sec. 645 election, it is made by filing Form 8855 with the Form 1041.

- Xero’s app store contains hundreds of apps that integrate with the accounting software.

You’ll also want to choose software that includes tools to help you market your business and properties and manage communications with your clients. If those tools aren’t built in to the accounting software you select, then be sure the software integrates with third-party apps to help you meet those needs. With the advent of technology, cloud-based accounting software has revolutionized the way real estate professionals handle their finances.

Why do property managers need trust accounts?

REITs come in various forms, each with its characteristics and investment focus. The primary categorization is based on the assets they hold and how they generate income. Equity REITs, for instance, own and manage income-producing real estate properties. In contrast, mortgage REITs invest in mortgages or mortgage-backed securities. Understanding the different types of REITs is crucial for investors to align their investment goals with the appropriate REIT category. With that in mind, this article will discuss how to assess the valuation of real estate investment trusts, including two step-by-step examples using a real, publicly-traded REIT.

Understanding Real Estate Investment Trusts – An Accountant’s Guide

An ESBT, defined at IRC § 1361(e)(1) with tax rules at section (c), holds the stock of an S corporation, with the shareholders as beneficiaries. A QSST, described in section 1361(d), likewise can hold the stock of an S corporation, with the beneficiary treated as its owner and the trust treated as a grantor trust. For more information on these trusts, see “Creative Ways of Achieving Grantor Trust Status,” The Tax Adviser, Sept. 2009, page 593. Most REITs lease space and collect rents, then distribute that income as dividends to shareholders. Mortgage REITs (also called mREITs) don’t own real estate; instead, they finance real estate.

- Understanding the different types of trust funds is essential for effective management and compliance with legal requirements.

- On the one hand, you want to be confident you can easily access money when an unpredictable bill arises because of a tenant accident.

- The frequency and amount of distributions can vary, though many REITs aim for consistent and growing dividends.

- The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets.

- Be sure to compare an REIT’s debt level to industry averages or debt ratios for competitors.

This liquidity is enhanced when the REIT is publicly traded on a major stock exchange. Additionally, REITs tend to offer diversification benefits, as they can own properties across a range of sectors and geographic real estate accounting locations. Because revocable trusts are both income tax and capital gains tax efficient, and revocable trusts are excellent for estate planning, revocable trusts are the most common type of trust.